How Clark Wealth Partners can Save You Time, Stress, and Money.

Wiki Article

What Does Clark Wealth Partners Do?

Table of ContentsThe Best Strategy To Use For Clark Wealth PartnersThe 8-Second Trick For Clark Wealth PartnersClark Wealth Partners Fundamentals ExplainedSome Known Facts About Clark Wealth Partners.4 Easy Facts About Clark Wealth Partners ExplainedThe Facts About Clark Wealth Partners UncoveredClark Wealth Partners Things To Know Before You Get ThisThings about Clark Wealth Partners

Common reasons to consider a monetary expert are: If your monetary situation has become extra intricate, or you lack confidence in your money-managing skills. Conserving or browsing significant life occasions like marital relationship, divorce, kids, inheritance, or work change that may substantially affect your financial situation. Browsing the change from saving for retirement to protecting riches during retirement and how to develop a strong retired life income plan.New innovation has actually brought about even more thorough automated financial tools, like robo-advisors. It depends on you to examine and identify the ideal fit - https://fliphtml5.com/homepage/clrkwlthprtnr/blanca-rush/. Inevitably, a great monetary expert must be as mindful of your investments as they are with their very own, preventing extreme fees, conserving cash on taxes, and being as transparent as feasible concerning your gains and losses

Clark Wealth Partners for Beginners

Making a payment on item recommendations does not always mean your fee-based advisor functions against your ideal passions. But they may be extra likely to advise services and products on which they make a commission, which might or may not be in your benefit. A fiduciary is lawfully bound to place their client's passions first.This common allows them to make referrals for investments and services as long as they fit their client's objectives, risk resistance, and financial scenario. On the various other hand, fiduciary consultants are legitimately obliged to act in their client's best rate of interest rather than their own.

Some Of Clark Wealth Partners

ExperienceTessa reported on all points spending deep-diving into intricate financial subjects, clarifying lesser-known financial investment methods, and uncovering means readers can function the system to their benefit. As an individual finance specialist in her 20s, Tessa is really knowledgeable about the effects time and uncertainty carry your financial investment decisions.

It was a targeted advertisement, and it worked. Learn more Read less.

6 Simple Techniques For Clark Wealth Partners

There's no solitary route to coming to be one, with some individuals beginning in banking or insurance coverage, while others start in find more accountancy. A four-year level offers a strong foundation for occupations in financial investments, budgeting, and customer solutions.

Getting The Clark Wealth Partners To Work

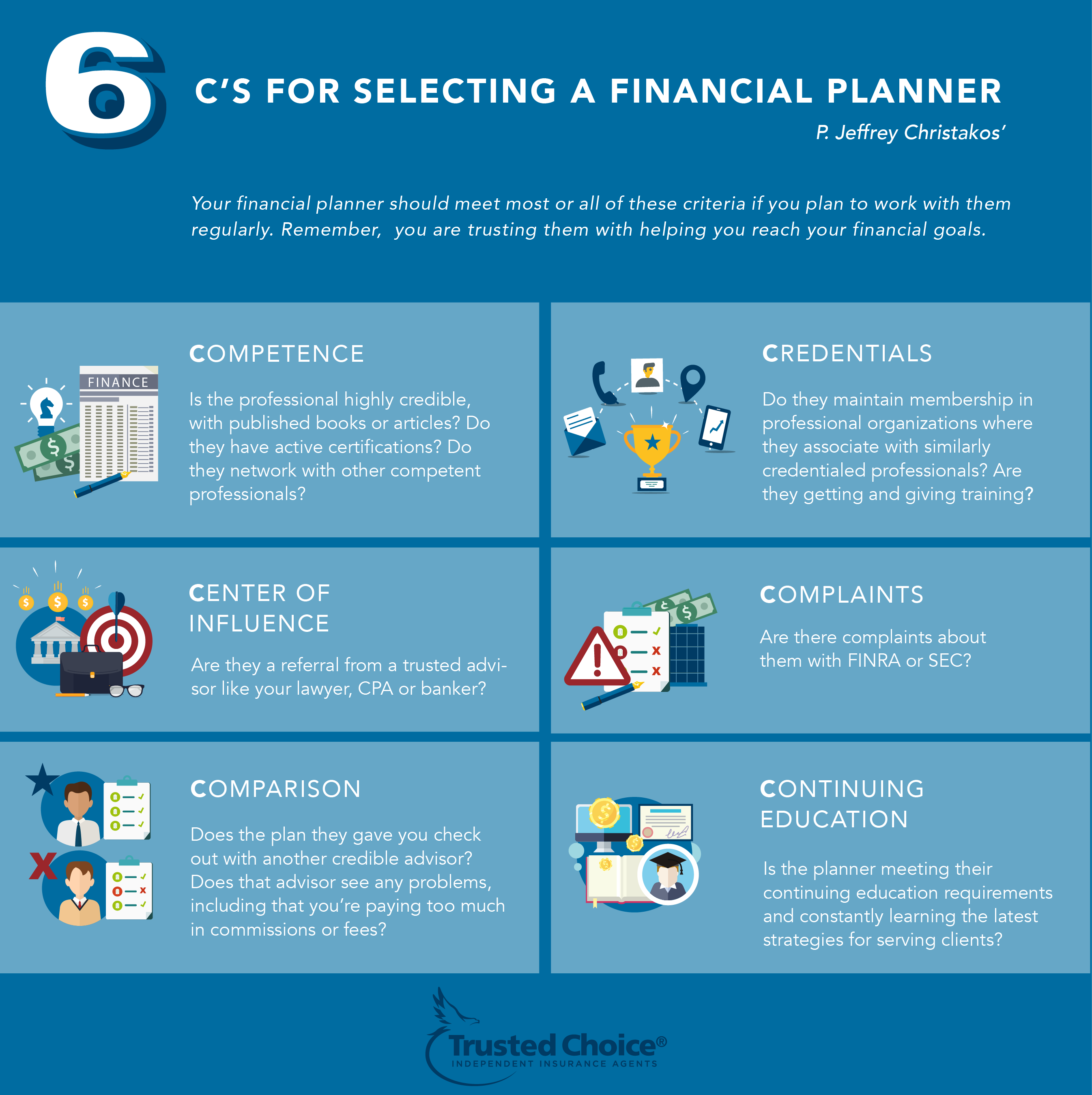

Typical instances consist of the FINRA Collection 7 and Collection 65 exams for safety and securities, or a state-issued insurance permit for selling life or medical insurance. While credentials might not be legally required for all planning duties, companies and customers often view them as a benchmark of expertise. We take a look at optional qualifications in the next section.Most monetary planners have 1-3 years of experience and knowledge with economic items, compliance standards, and direct client communication. A solid instructional background is essential, yet experience demonstrates the capacity to use concept in real-world settings. Some programs incorporate both, permitting you to finish coursework while making monitored hours with internships and practicums.

Examine This Report about Clark Wealth Partners

Early years can bring long hours, stress to build a customer base, and the demand to continuously confirm your competence. Financial planners take pleasure in the opportunity to work closely with customers, overview crucial life decisions, and typically achieve versatility in timetables or self-employment.

They invested much less time on the client-facing side of the market. Nearly all economic supervisors hold a bachelor's degree, and many have an MBA or similar graduate level.

Clark Wealth Partners Things To Know Before You Buy

Optional accreditations, such as the CFP, usually call for additional coursework and testing, which can expand the timeline by a couple of years. According to the Bureau of Labor Stats, personal financial experts gain a mean annual yearly income of $102,140, with top income earners making over $239,000.In various other districts, there are regulations that need them to meet certain needs to use the financial consultant or financial coordinator titles. For financial coordinators, there are 3 typical designations: Certified, Personal and Registered Financial Planner.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Those on income may have a reward to advertise the product or services their employers use. Where to find a financial consultant will depend upon the kind of guidance you require. These organizations have team that might help you comprehend and purchase specific types of financial investments. Term deposits, guaranteed financial investment certifications (GICs) and common funds.Report this wiki page